child tax credit 2022 income limit

Are you using any. These payments were part of the American Rescue.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

COVID Tax Tip 2022-31 February 28 2022 The EITC is one of the federal governments largest refundable tax credits for low-to moderate-income families.

. In the meantime the expanded child tax credit and advance monthly payments system have expired. Changes to the Child Tax Credit for 2022 include lower income limits than the original credit. 3000 per child 6-17 years old.

For children under 6 the CTC is 3600 with 300 optional monthly. Tax Changes and Key Amounts for the 2022 Tax Year. According to the IRS website working families will be eligible for the whole child tax credit if.

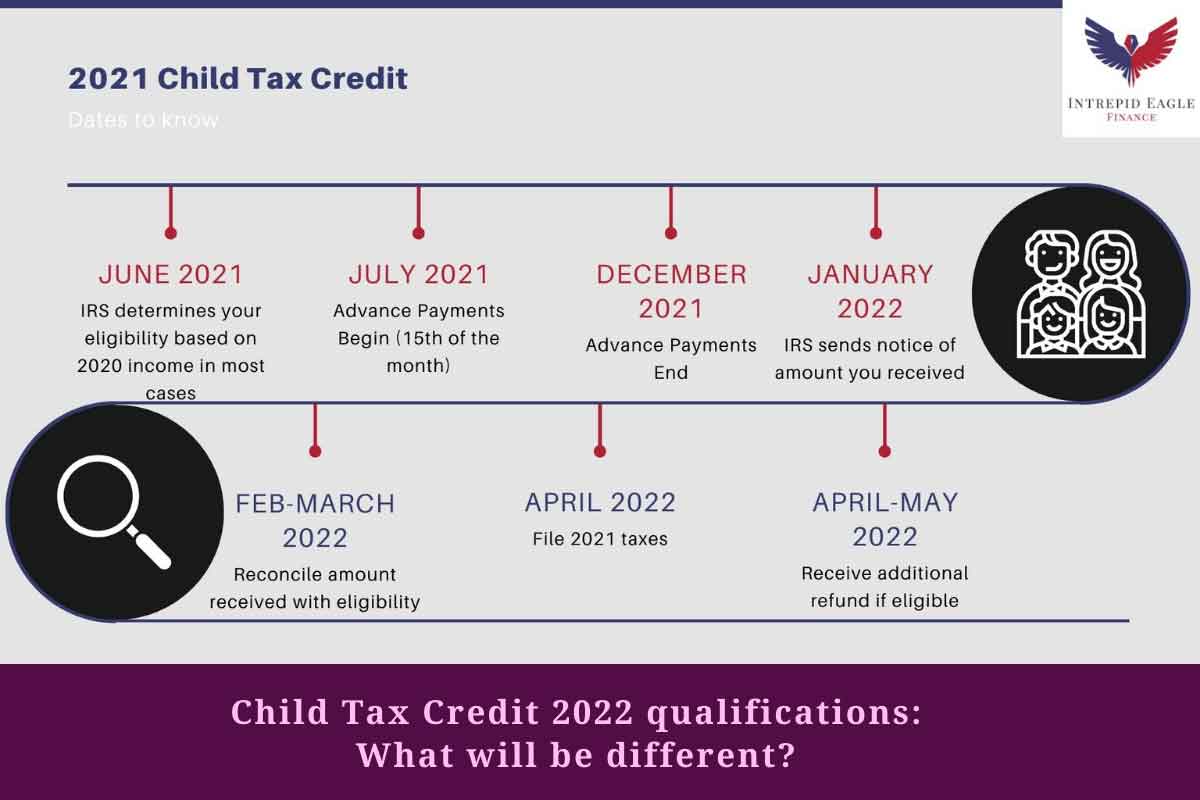

When you go through the process of filling out your 2021 tax return you will be able to claim the full credit for your newborn dependent. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. The first one applies to.

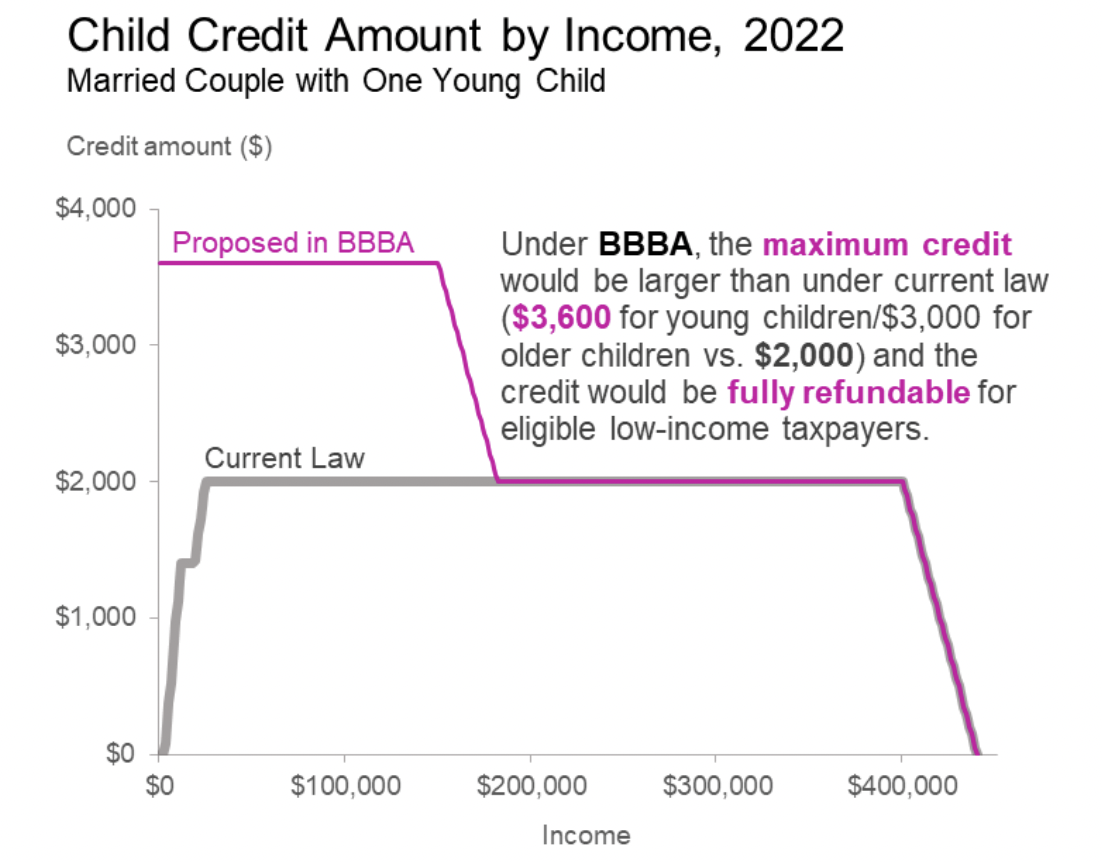

They earn 112500 or less for a family with a. Making the credit fully refundable. Thats because the child tax credit is dropping to 2000 for the year.

The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17. The income limit to claim the full child tax credit is 400000 for joint filers and. 3600 per child under 6 years old.

Families who do not qualify under these new income limits are still eligible to. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. TikTok video from Virtual Tax Pro virtualtaxpro.

Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year. Will be able to receive the full. Those applicants may see that extra money relatively soon.

All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single. 9 hours agoTo apply visit the departments website and click on 2022 CT Child Tax Credit Rebate For the tax credit income thresholds have been established according to the release. In 2017 this amount was.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to. Parents with higher incomes also have two phase-out schemes to worry about for 2021. 11 hours agoIn Vermont the Governor signed this into law for families who make less than 12500 or less each year.

The child tax credit has been increased from 2000 to 3000 or 36000 depending on the age of the qualifying child. Yes so for the full credit there is an income limitSo under 75000 if youre single and under 150000 married filing jointly you would get the full credit. The filer status Income threshold.

What are the Maximum Income Limits for the Child Tax Credit 2022. The child tax credit is a credit that can reduce your Federal tax bill by up to 3600 for every qualifying child. They earn 150000 or less per year for a married couple.

Each family that claims the Child Tax. Read more about it here. Ct taxrebate childtaxcredit childtaxcredit2021 ctmoms conneticut conneticutmomstaxes statetaxes rebate.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. 14 hours agoConnecticut residents can apply for the child tax credit on the DRSs website here. The child tax credit is worth up to 2000 for each eligible child you have aged 16 or younger.

Child Tax Credit Calculator for 2021 2022. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100. The third round of Economic Impact Payments including the plus-up payments were advance payments of the 2021 Recovery Rebate Credit claimed on a 2021 tax return.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if.

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contracto Income Tax Federal Income Tax Tax

What Families Need To Know About The Ctc In 2022 Clasp

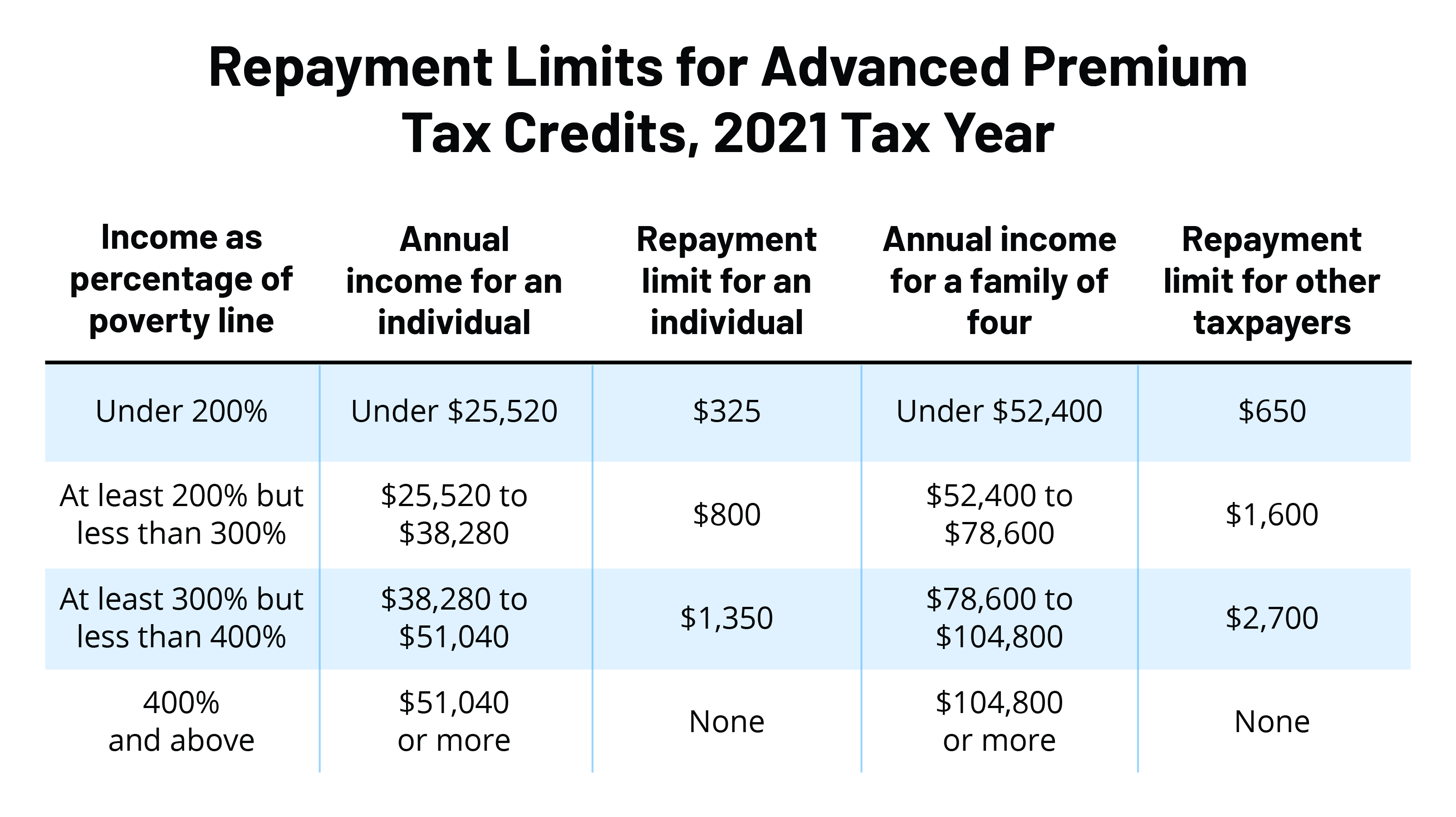

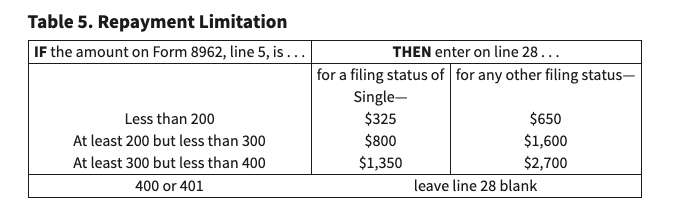

What S The Most I Would Have To Repay The Irs Kff

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Pin By Susan Bucki On Home Health Tips In 2022 Adjusted Gross Income Tax Credits Income Tax Return

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Who Has To File Income Tax Return Mandatorily You May Be Liable To File Your Income Tax Return Itr This Time Even Income Tax Return Filing Taxes Income Tax

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Advanced Tax Credit Repayment Limits

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

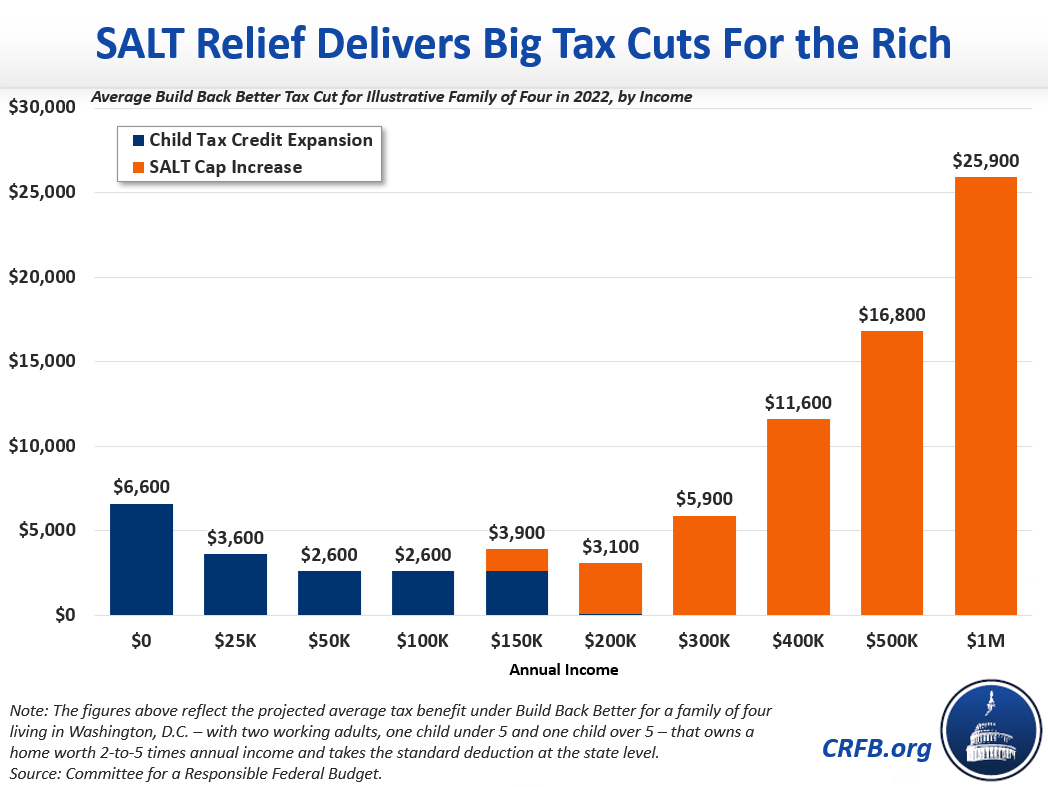

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Ctc Payments 2022 What Is The Additional Child Tax Credit Marca